Smart Moves for School Costs: What I Learned Investing Early

Raising a teenager, I once stared at tuition bills feeling overwhelmed. How could I keep up without sacrificing everything? Then it hit me—education expenses aren’t just costs; they’re long-term investments. With the right strategies, you can grow funds wisely while managing risks. This is the real talk I wish I’d heard earlier—practical, tested steps to turn stress into smart financial moves. It’s not about having the most money; it’s about making thoughtful choices early, staying consistent, and protecting your family’s future. The journey isn’t perfect, but with clarity and purpose, you can build a foundation that lasts far beyond the school years.

The Hidden Investment in Your Child’s Education

Education is often seen as an unavoidable expense, something to be paid rather than planned for. But when parents shift their perspective, they begin to see school costs as one of the most meaningful investments they will ever make. This isn’t just about covering tuition or buying supplies—it’s about laying a financial foundation that supports long-term growth, opportunity, and stability. Middle school is a pivotal moment, when academic expectations rise and extracurricular demands increase. It’s also the ideal time to start preparing financially. Families who begin saving during these early years give themselves a powerful advantage: time. Time allows even modest contributions to grow through compounding, where returns generate their own returns over months and years. For example, setting aside $100 a month starting at age 12, with a conservative annual return of 5%, could grow to over $9,000 by age 18. That kind of growth doesn’t require market timing or risky bets—it simply requires starting early and staying consistent.

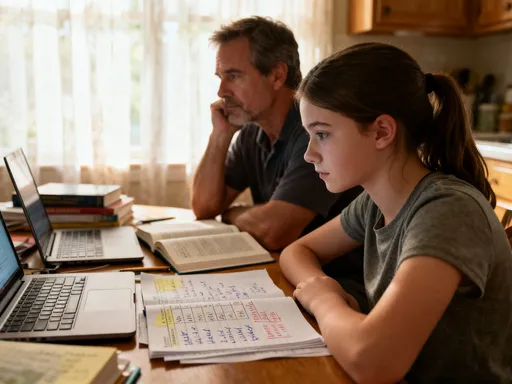

Treating education as an investment changes the way decisions are made. Instead of reacting to sudden bills or last-minute fees, parents begin to anticipate needs and plan accordingly. This proactive mindset fosters better budgeting, clearer priorities, and reduced financial stress. It also encourages conversations about money within the family, helping children understand the value of education and the effort behind funding it. When children see their parents saving intentionally, they internalize habits of discipline and responsibility. These lessons go beyond academics—they shape lifelong financial behavior. Moreover, early planning allows families to explore a wider range of educational opportunities, from specialized programs to private institutions, without being limited by immediate cash flow. The key is recognizing that every dollar saved today reduces the burden of borrowing tomorrow. And unlike other investments, the return on education isn’t measured solely in financial terms—it’s reflected in confidence, capability, and future earning potential.

Another benefit of this investment mindset is the ability to align savings with broader financial goals. Education funding doesn’t have to exist in isolation. It can be integrated into a family’s overall financial plan, working alongside retirement savings, emergency funds, and home ownership goals. By viewing education as part of a larger strategy, parents avoid the trap of over-prioritizing one area at the expense of others. For instance, it’s unwise to drain retirement accounts to pay for school, as that can create new financial vulnerabilities later in life. Instead, balanced planning ensures that all critical goals receive attention. Tools like automatic transfers, dedicated savings accounts, and periodic reviews help maintain this balance. The earlier these systems are put in place, the more seamlessly they become part of everyday life. Ultimately, the goal isn’t perfection—it’s progress. Starting small, staying consistent, and adjusting as needed builds resilience and confidence over time.

Where Families Typically Go Wrong

Despite good intentions, many families make financial missteps when it comes to education funding. These mistakes are rarely due to lack of care—they stem from emotional decisions, misinformation, or simply not knowing where to begin. One of the most common errors is waiting too long to start saving. Some parents believe it’s too early to think about high school or college costs when their child is still in middle school. Others assume that scholarships or financial aid will cover most expenses. While these supports exist, they are never guaranteed and often insufficient to meet full costs. Delaying savings means missing out on years of compounding growth, forcing families to play catch-up later with larger, more difficult contributions. By the time children reach high school, the window for low-effort accumulation has closed, leaving parents to rely on loans, credit cards, or sudden budget cuts.

Another widespread issue is reactive spending. When unexpected fees arise—such as for field trips, technology requirements, or specialized courses—families may resort to high-interest credit cards or personal loans. These short-term solutions can lead to long-term debt, especially if balances are carried month after month. Interest charges add up quickly, turning a $500 expense into a $700 or $800 burden over time. Similarly, some parents feel pressure to keep up with peers by enrolling their children in expensive tutoring, elite summer programs, or private schools without evaluating whether these choices align with their budget or the child’s actual needs. This kind of emotional spending often stems from fear—fear of falling behind, fear of limiting opportunities, or fear of judgment from others. But without a clear plan, these decisions can erode financial stability and create unnecessary stress.

A third pitfall is the failure to build an emergency education fund. Just as households need a general emergency fund for unexpected repairs or medical bills, they also benefit from setting aside money specifically for education-related surprises. A sudden school change, a required competition fee, or a missed scholarship can all disrupt even the best-laid plans. Without a buffer, families may be forced to make hasty decisions, such as withdrawing from retirement accounts or taking on debt. These actions not only impact current finances but can also delay other long-term goals. The solution is not to eliminate spending on enrichment but to anticipate it. By creating a dedicated line in the budget for variable education costs, families gain flexibility and peace of mind. Awareness of these common mistakes is the first step toward avoiding them. Recognizing the patterns allows parents to replace reaction with strategy, emotion with intention, and uncertainty with control.

Building Your Education Fund: Start Small, Think Big

One of the most empowering truths about saving for education is that you don’t need a large income to make meaningful progress. What matters most is consistency, discipline, and the right tools. Many families hesitate to start because they believe they must set aside hundreds of dollars each month to make a difference. In reality, even small, regular contributions can grow significantly over time. The key is to begin, no matter how modest the amount. A $25 weekly transfer into a dedicated savings account may seem insignificant at first, but over six years, that adds up to $7,800—before any interest or investment gains. When combined with compound growth, the total can be even higher. The power lies not in the size of the contribution but in the habit of saving and the time it has to grow.

Choosing the right savings vehicle is equally important. Families should look for options that are accessible, low-cost, and designed to support long-term growth. In some countries, government-sponsored education savings plans offer tax advantages and incentives for contributors. Where these aren’t available, custodial accounts or dedicated savings accounts can serve a similar purpose. The goal is to keep education funds separate from everyday spending accounts, reducing the temptation to dip into them for non-essential purchases. Automation is one of the most effective tools for building consistency. Setting up automatic transfers from a checking account to a savings account ensures that contributions happen regularly, even during busy or stressful times. This “set it and forget it” approach removes the need for constant decision-making and makes saving a seamless part of financial life.

Another smart strategy is to align contributions with irregular income sources. Instead of waiting for a perfect moment to start, families can use windfalls like tax refunds, work bonuses, or gift money to jump-start or boost their education fund. For example, redirecting a $1,200 tax refund into savings is equivalent to adding $100 per month for a year. These one-time contributions can significantly accelerate progress without impacting regular cash flow. Similarly, adopting a “round-up” habit—where small daily purchases are rounded up and the difference saved—can generate additional funds over time with little effort. The focus should always be on sustainability. A plan that feels overwhelming or unrealistic is unlikely to last. Starting small, celebrating milestones, and adjusting as income changes helps maintain motivation and long-term success. The message is clear: you don’t need to be wealthy to save wisely—you need to be intentional.

Balancing Risk and Growth Without Losing Sleep

When saving for a child’s education, the balance between safety and growth is crucial. On one hand, parents naturally want to protect their savings from loss, especially as the time to use the funds approaches. On the other hand, keeping all money in low-yield savings accounts can be risky in its own way—particularly when inflation outpaces interest rates. Over time, the purchasing power of stagnant funds can erode, meaning that even a fully funded account may not cover future costs. The solution lies in a thoughtful, time-based strategy that adjusts risk levels as the child grows. In the early years, when there is more time before the money is needed, a portion of the fund can be allocated to moderate-growth investments such as index funds or diversified mutual funds. These options carry some market risk but historically offer higher returns over the long term, helping savings keep pace with rising education costs.

As the child moves into high school, the strategy should gradually shift toward capital preservation. This means reducing exposure to volatile assets and increasing allocations to stable instruments like bonds, certificates of deposit, or high-yield savings accounts. The goal during this phase is not rapid growth but protection of accumulated value. This approach, known as a “glide path,” mirrors strategies used in retirement planning and helps ensure that funds are available when needed. Diversification plays a key role in managing risk at every stage. Spreading investments across different asset types reduces the impact of any single market downturn. For example, if one sector underperforms, others may hold steady or even gain, balancing the overall portfolio. This doesn’t eliminate risk entirely, but it makes outcomes more predictable and less emotionally taxing for families.

Inflation protection is another often-overlooked aspect of education funding. Tuition and related costs tend to rise faster than general inflation, sometimes by 3% to 5% annually. A savings plan that earns only 1% interest will fall behind, requiring larger out-of-pocket payments later. That’s why even conservative investors should consider some exposure to growth-oriented assets, especially in the early years. The aim is not to chase high returns or speculate on market trends, but to ensure that savings maintain their real value over time. Regular portfolio reviews—once a year or after major life events—help keep the strategy on track. These check-ins allow families to assess performance, rebalance allocations, and make adjustments based on changing goals or timelines. By combining prudence with purpose, parents can grow their funds wisely while sleeping soundly at night.

Cutting Costs Without Cutting Corners

Saving for education isn’t only about how much you put in—it’s also about how wisely you spend. Many families overlook the power of strategic cost management, focusing solely on increasing income or investments. Yet, reducing unnecessary expenses can be just as effective as earning more. The key is to distinguish between essential and non-essential spending, and to seek value without sacrificing quality. For example, textbooks and learning materials can be expensive, but alternatives like library rentals, used books, or digital versions often provide the same educational benefit at a fraction of the cost. Similarly, technology needs—such as laptops or tablets—don’t always require the latest models. A reliable, gently used device can serve a student well for years, especially when paired with protective cases and regular maintenance.

Extracurricular activities, while valuable, can also become a major budget drain. Instead of enrolling in multiple paid programs, families can explore community-based options, school-sponsored clubs, or group arrangements with other parents. Carpooling to practices, sharing equipment, or organizing bulk registrations can lead to significant savings. Summer programs, often marketed as essential for college applications, vary widely in cost and value. Booking early, applying for scholarships, or choosing local alternatives can reduce expenses without diminishing the experience. Even tutoring doesn’t have to be expensive. Peer study groups, online resources, and free school-provided support can be highly effective, especially when combined with consistent effort and good study habits.

Another area for savings is planning and timing. Families who wait until the last minute to pay fees or book services often pay more. Registering early for exams, camps, or trips usually comes with discounts or lower rates. Similarly, spreading payments over time—rather than making a single large outlay—can ease cash flow pressure. Some schools offer installment plans for tuition, which can help families manage costs without straining their budget. The goal is not to eliminate enriching experiences but to approach them with intention. Every dollar saved through smart spending is a dollar that can be reinvested into the education fund or used for future needs. By adopting a mindset of value over convenience, families gain greater control over their finances and reduce reliance on borrowing. Thoughtful spending isn’t about deprivation—it’s about making choices that align with long-term goals and family well-being.

When Life Changes the Plan—And How to Adapt

Even the most careful financial plans can be disrupted by unexpected events. Job loss, medical emergencies, family changes, or school transitions can all alter the trajectory of education funding. In these moments, flexibility becomes as important as preparation. The goal isn’t to avoid setbacks—those are inevitable—but to build a strategy that can absorb them without collapsing. One of the most effective ways to do this is by maintaining liquidity. This means keeping a portion of the education fund in accessible accounts, such as high-yield savings or short-term certificates, so that money can be used quickly if needed. While long-term investments are important for growth, having cash reserves provides breathing room during crises, reducing the need to sell assets at a loss or take on debt.

Another key element of resilience is having backup funding sources. This might include a general emergency fund, access to low-interest credit (used responsibly), or support from extended family. It’s also wise to explore alternative educational paths if circumstances change. For example, starting at a community college before transferring to a four-year institution can significantly reduce overall costs. Some students may benefit from taking a gap year to work and save, especially if it allows them to enter college with less financial pressure. These aren’t failures—they are smart adaptations that reflect real-life conditions. The important thing is to reassess goals without guilt. Financial setbacks do not reflect personal worth, and adjusting a plan is not a sign of defeat but of wisdom.

Communication is also essential during times of change. Families should talk openly about financial realities, involving older children in discussions when appropriate. This builds trust, reduces anxiety, and helps everyone understand the reasons behind decisions. It also reinforces the idea that education is a shared priority, not just a parent’s burden. Regular check-ins allow families to monitor progress, identify new challenges, and make informed adjustments. Whether it’s pausing contributions temporarily, shifting investment allocations, or revising long-term goals, the ability to adapt ensures that the plan remains relevant and achievable. Life is unpredictable, but with a flexible, thoughtful approach, families can navigate change without losing sight of their objectives.

Looking Beyond Tuition: The Full Picture of Educational Value

Ultimately, funding a child’s education is about more than paying bills—it’s about creating opportunities and building a legacy of financial wisdom. Every dollar saved, every smart decision made, contributes not only to academic access but to long-term family well-being. The true measure of success isn’t just whether a student can attend a certain school, but whether the family maintains stability, peace of mind, and the freedom to choose. Thoughtful financial planning empowers parents to support their children without sacrificing their own future or accumulating burdensome debt. It allows for choices rather than compromises, and confidence rather than anxiety.

Equally important is the example being set. When children see their parents budgeting, saving, and making informed decisions, they learn to do the same. These habits become part of their financial identity, influencing how they manage money in college and beyond. They learn that goals are achieved through discipline, not luck, and that long-term thinking leads to better outcomes. In this way, education funding becomes a form of intergenerational wealth building—not just in dollars, but in values, knowledge, and resilience. The benefits extend far beyond the classroom, shaping careers, relationships, and life choices.

As children grow and move toward independence, the financial foundation laid during their school years continues to support them. Whether they pursue higher education, vocational training, or enter the workforce directly, they do so with the knowledge that preparation matters. And parents, having navigated the challenges with care and purpose, can look back with pride—not because they had the most money, but because they made the smartest moves. The journey of funding education is not easy, but it is deeply meaningful. It reflects love, commitment, and foresight. With the right strategies, every family can turn financial pressure into lasting empowerment.