Passing the Torch: Smart Moves to Grow and Guard Family Wealth

Family wealth isn’t just about how much you have—it’s about how wisely you manage it for future generations. I’ve seen families thrive and others stumble, all because of their choices. In this article, I’ll walk you through practical financial methods that focus on lasting value, risk control, and smart planning. It’s not about quick wins, but long-term strength. The real challenge isn’t earning wealth—it’s preserving it across decades, through changing markets and shifting family dynamics. Without clear structure and shared understanding, even substantial assets can dwindle within a generation. This guide offers a grounded, actionable approach to building financial resilience that lasts.

The Real Challenge Behind Family Wealth

Wealth preservation begins not with balance sheets, but with awareness—awareness of the subtle forces that quietly erode family assets over time. Many families assume that once a certain level of financial success is achieved, stability naturally follows. Yet history and experience show otherwise. Studies suggest that nearly 70% of affluent families lose their wealth by the second generation, and about 90% by the third. The cause is rarely sudden market collapse or fraud; instead, it’s a combination of poor communication, lack of planning, and emotional decision-making that chips away at the foundation.

The real challenge lies in recognizing that money, when left unmanaged within a family context, becomes more than a tool—it becomes a source of tension, expectation, and sometimes division. Overspending, especially when younger members are given access without accountability, can deplete resources faster than any investment loss. Unstructured inheritance—such as sudden lump-sum transfers—often leads to mismanagement, not empowerment. Without clear guidelines, even well-intentioned gifts can create dependency or resentment among siblings and cousins.

Generational transitions amplify these risks. As parents age and begin to consider succession, emotions often override logic. One child may feel overlooked, another pressured to take on responsibilities they’re unprepared for. These dynamics are further complicated by differing lifestyles, values, and financial literacy levels. A parent might assume their children share the same long-term vision, only to discover too late that one views wealth as a means to security while another sees it as a ticket to freedom and risk.

What separates enduring family wealth from fleeting affluence is intentionality. It’s the deliberate choice to treat wealth not as a private matter to be avoided in conversation, but as a shared responsibility that requires alignment. Families who succeed do so because they establish clarity around purpose: Why does this wealth exist? Is it to fund education, support charitable causes, or ensure independence across generations? Answering these questions early helps anchor decisions in values rather than impulses. The shift is from passive ownership to active stewardship—a mindset that sees wealth as a legacy to be nurtured, not merely enjoyed.

Building a Foundation: Asset Protection First

Before any discussion of growth or distribution, there must be protection. Just as a house needs a strong foundation to withstand weather and time, family wealth requires structural safeguards to endure legal, financial, and personal risks. The first step in preserving wealth is not investing it more aggressively, but shielding it from avoidable threats. These threats come in many forms: lawsuits, creditors, divorce settlements, or even poor financial decisions by beneficiaries. Without proper legal structures, a single event can unravel decades of careful accumulation.

One of the most effective ways to protect family assets is through the use of trusts. A trust is a legal arrangement in which a person (the grantor) transfers ownership of assets to a trustee, who manages them for the benefit of others (the beneficiaries). This separation of ownership from control allows wealth to be preserved according to specific rules, even after the original owner is no longer managing it. For example, a trust can stipulate that funds be used only for education, health, or housing, preventing reckless spending. It can also delay full access until beneficiaries reach certain ages, ensuring maturity before large sums are released.

Family limited partnerships (FLPs) and holding companies are other common tools used to consolidate and protect wealth. These entities allow families to pool assets—such as real estate, investment portfolios, or business interests—under a single legal structure. By doing so, they gain several advantages: centralized management, reduced exposure to individual liabilities, and greater control over how and when assets are transferred. For instance, a parent can gradually transfer partnership shares to children over time, maintaining operational control while reducing the taxable estate.

Equally important is the principle of separating personal finances from family wealth. When business assets, investment accounts, and personal spending are all mixed together, it becomes difficult to track performance, assess risk, or plan for succession. Clear boundaries help prevent commingling, which can lead to legal vulnerabilities in cases of divorce or litigation. They also make it easier to bring in outside advisors—such as accountants, attorneys, or financial planners—without exposing private family details unnecessarily.

Equally critical is the appointment of responsible stewards. These individuals—whether family members or trusted professionals—play a key role in managing protected assets. They must be chosen not only for their financial acumen but also for their integrity and commitment to the family’s long-term goals. A poorly selected trustee or partner can cause conflict, mismanagement, or even legal disputes. Early planning allows time to educate and prepare these stewards, ensuring continuity and trust.

Growing Wealth Across Generations: The Investment Mindset Shift

Protecting wealth is essential, but it is not enough. To maintain purchasing power over decades, family assets must grow—but not through speculation or chasing short-term trends. The goal is not to achieve the highest possible return in a single year, but to generate consistent, resilient growth that outpaces inflation and supports future needs. This requires a fundamental shift in mindset: from viewing investments as a way to get rich quickly, to seeing them as a means of long-term preservation and gradual expansion.

At the core of sustainable wealth growth is capital preservation. This principle means prioritizing safety and stability over high-risk opportunities. While aggressive strategies may yield dramatic gains in bull markets, they often lead to devastating losses during downturns. Families with multi-generational goals cannot afford such volatility. Instead, they focus on asset classes with proven track records of steady performance: high-quality bonds, dividend-paying stocks, income-generating real estate, and private business investments. These holdings may not make headlines, but they build value quietly and reliably over time.

Diversification remains one of the most powerful tools available. By spreading investments across different asset types, industries, and geographic regions, families reduce their exposure to any single point of failure. A downturn in the stock market may affect one portion of the portfolio, but real estate or private equity holdings might remain stable—or even appreciate. This balance helps smooth out returns and reduces the emotional temptation to react impulsively during market swings.

Another key element is minimizing turnover. Frequent buying and selling incur transaction costs, tax liabilities, and the risk of mistiming the market. Low-turnover strategies, by contrast, emphasize holding quality assets for the long term. This approach aligns with the compounding effect—the idea that returns generate their own returns over time. A portfolio that earns 6% annually and reinvests those gains will double in value approximately every 12 years. Over multiple generations, this effect becomes transformative.

Liquidity must also be carefully managed. While long-term growth is the priority, families still need access to cash for emergencies, education expenses, or healthcare needs. A well-structured investment plan includes a tiered approach: a portion of assets held in liquid, easily accessible accounts, while the majority remains invested for growth. This balance ensures flexibility without sacrificing long-term objectives.

Finally, investment decisions should reflect family values. Some families choose to avoid industries such as tobacco or fossil fuels, opting instead for environmental, social, and governance (ESG)-aligned investments. Others prioritize local economic development or support family-owned businesses. When financial choices align with shared beliefs, they strengthen unity and give wealth a deeper sense of purpose.

The Hidden Power of Governance: Rules That Keep Families United

Without structure, money can divide even the closest families. This is why governance—the system of rules, roles, and responsibilities around financial decision-making—is one of the most underappreciated yet vital components of lasting wealth. Governance doesn’t imply bureaucracy or cold formality; rather, it provides clarity and fairness, reducing the potential for conflict and misunderstanding. It transforms wealth from a source of tension into a shared project that brings family members together.

One effective governance tool is the family council—a regular meeting where members discuss financial matters, review performance, and make collective decisions. These gatherings can include parents, adult children, and even grandchildren, depending on age and interest. The format varies: some families meet annually, others quarterly. What matters most is consistency and inclusion. When younger members are invited to observe or contribute, they begin to understand the responsibilities that come with wealth.

A wealth charter or family constitution is another powerful instrument. This written document outlines the family’s financial values, goals, and operating principles. It might state that wealth exists to support education and entrepreneurship, not luxury lifestyles. It could define expectations for financial literacy, work ethic, or community involvement. While not legally binding, a charter serves as a moral compass, guiding behavior and resolving disputes. When disagreements arise, families can refer back to their shared agreement rather than relying on emotion or personal opinion.

Clear roles are essential. Who manages investments? Who communicates with advisors? Who makes decisions during a crisis? Assigning these responsibilities prevents confusion and power struggles. In some families, a senior member acts as chair, while others serve on advisory boards. In more formal setups, an independent fiduciary or family office may oversee operations. The key is transparency—everyone should know who is accountable for what.

Education is a cornerstone of governance. Children raised in wealthy families often lack basic financial skills because money was never discussed openly. Yet understanding budgeting, saving, and investing is crucial for future stewards. Many successful families introduce financial literacy early, through age-appropriate lessons, hands-on experiences, and mentorship. Some even establish small personal portfolios for teens, allowing them to learn from real gains and losses under supervision.

When governance works, it creates a culture of accountability and shared purpose. It ensures that wealth serves the family, rather than the family serving the wealth. By setting expectations and fostering open dialogue, families build resilience that goes beyond numbers on a balance sheet.

Tax Smarts: Minimizing Losses, Not Dodging Laws

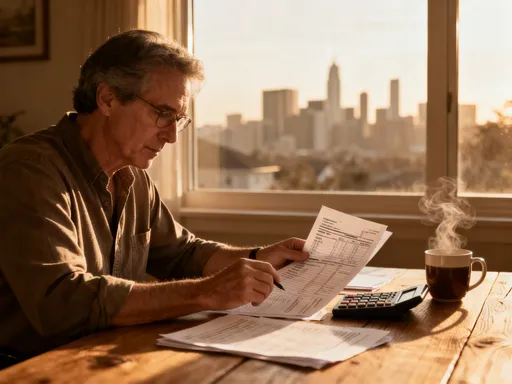

Taxes are one of the most predictable yet frequently overlooked threats to family wealth. Unlike market downturns or legal disputes, tax liabilities are certain to occur—but their impact can be significantly reduced with foresight and planning. The goal is not to evade taxes, which is both illegal and risky, but to minimize them legally through smart structuring and timing. Every dollar saved in taxes is a dollar that stays in the family, compounding over time.

One of the most effective strategies is gifting during life rather than transferring everything at death. Most countries offer annual gift tax exclusions, allowing individuals to transfer a certain amount to others without incurring tax. By using this exemption consistently, families can gradually shift assets to younger generations while reducing the size of the taxable estate. For example, a married couple might gift up to a significant sum each year to each child and grandchild, effectively moving millions over a decade without triggering tax liability.

Another key concept is stepped-up basis. In many jurisdictions, when an asset is inherited, its cost basis is adjusted to its market value at the time of death. This can eliminate capital gains tax that would have been due if the asset had been sold during the owner’s lifetime. Families who understand this principle can time transfers strategically—holding appreciated assets until inheritance, when the tax burden resets. This simple rule can save hundreds of thousands in taxes, especially on long-held real estate or stock portfolios.

Tax-advantaged accounts and structures also play a crucial role. Retirement accounts, education savings plans, and certain trust types offer favorable tax treatment when used correctly. While rules vary by country, the principle remains the same: using available tools to defer, reduce, or eliminate taxes on income and gains. Families who review these options regularly with qualified advisors ensure they’re not leaving money on the table.

Timing matters. Large asset sales, business exits, or real estate transactions can trigger substantial tax bills if not planned carefully. Spreading gains over multiple years, offsetting with losses, or reinvesting in qualified opportunities can reduce the burden. Similarly, charitable giving—when structured as part of an overall plan—can provide tax benefits while supporting causes the family cares about.

Perhaps the greatest mistake is treating tax planning as a one-time event. Tax laws change, family circumstances evolve, and new opportunities emerge. A strategy that works today may not be optimal tomorrow. Regular reviews—ideally annually—help families stay ahead of shifts and maintain efficiency. The most successful families treat tax planning not as a chore, but as an ongoing discipline, integrated into their broader financial management.

Preparing the Next Generation: More Than Just Inheritance

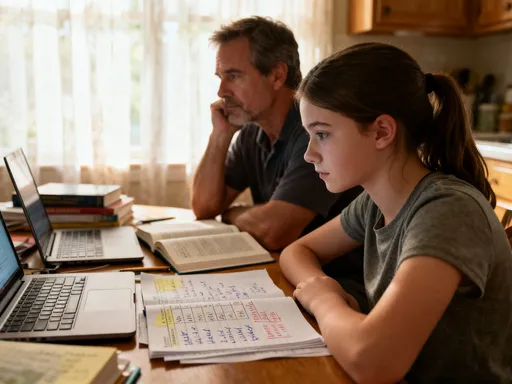

Passing down wealth is not simply a financial transaction—it is a transfer of responsibility. The danger lies not in giving too little, but in giving too much too soon, without preparing the recipient. Sudden wealth, especially to young or inexperienced individuals, can distort motivation, erode work ethic, and create a sense of entitlement. The goal is not to withhold, but to equip—ensuring that heirs are emotionally, intellectually, and ethically ready to manage what they will inherit.

Financial education is the starting point. Many parents assume their children will “figure it out,” but without guidance, even intelligent adults can make costly mistakes. Teaching budgeting, investing, tax basics, and risk management should begin early, tailored to the child’s age and maturity. For teenagers, this might mean managing a small allowance or saving for a car. For young adults, it could involve overseeing a modest investment account or participating in family financial discussions.

Gradual exposure to decision-making builds confidence and competence. Some families use “shadow boards,” where younger members observe investment meetings or review portfolio performance without voting rights. Others create small personal trusts that allow heirs to make limited investment choices under supervision. These experiences teach accountability—what it feels like to gain or lose money based on one’s own decisions.

Mentorship is equally important. Connecting younger family members with experienced advisors, business leaders, or even older relatives who have managed wealth responsibly helps transfer wisdom beyond numbers. These relationships provide guidance, encouragement, and real-world context. They also help heirs see themselves not just as beneficiaries, but as stewards in a larger story.

The emotional dimension cannot be ignored. Wealth can complicate identity—some may feel pressure to live up to expectations, while others struggle with guilt or lack of purpose. Open conversations about these feelings help normalize them and prevent isolation. Families that discuss values, work, and contribution create a healthier relationship with money—one based on meaning rather than materialism.

Ultimately, the goal is independence, not dependency. Inheritance should empower, not replace effort. Many successful families tie access to funds to milestones such as completing education, holding a job for a certain period, or launching a business. These conditions are not meant to control, but to foster growth. When heirs earn their way into greater responsibility, they are more likely to respect and preserve the wealth they inherit.

Putting It All Together: Creating Your Family’s Financial Blueprint

Enduring family wealth is not the result of a single decision, but of a coherent, evolving plan. The final step is to bring all the elements—protection, growth, governance, tax efficiency, and education—into a unified financial blueprint. This is not a rigid document, but a living framework that adapts as the family grows, markets change, and goals evolve. It begins with a clear assessment: Where is the family today? What assets exist? Who are the stakeholders? What values guide financial choices?

From there, gaps can be identified. Are assets unprotected? Is there no succession plan? Are younger members uninvolved in financial discussions? Prioritizing actions based on urgency and complexity allows families to make progress without feeling overwhelmed. Some may start with setting up a trust, others with launching a family council. The important thing is to begin—perfection is not required, only intention.

The blueprint should include measurable objectives: funding education for all grandchildren, maintaining a certain level of annual income, or preserving a family business for another generation. It should also define review points—times when the plan is reassessed, such as every three to five years, or after major life events like marriage, birth, or retirement.

Advisors play a crucial role in this process. A team of trusted professionals—financial planners, attorneys, accountants—can provide objective insight and help implement complex strategies. But the family must remain in the driver’s seat. Advisors guide, but the values and decisions belong to the family.

Finally, the mindset shift must be internalized: wealth is not static. It requires maintenance, attention, and periodic renewal. Just as a home needs repairs and upgrades, a financial plan needs updates and adjustments. With consistent effort, open communication, and a focus on stewardship, family wealth can become more than a number—it can become a force for stability, opportunity, and legacy. The torch can be passed, not just with assets, but with wisdom.